Fire Truck Industry Overview

The global fire truck market size was valued at USD 4,631.1 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030.

The necessity for advanced firefighting equipment and the rising demand for fire safety in developed nations are anticipated to boost the market expansion forfire trucks. A substantial increase in demand for fire safety among developed countries and the need for advanced firefighting equipment are factors expected to augment the market growth. Furthermore, improving standards concerning safety across the globe are expected to aid the demand for advanced fire trucks in the coming years.

Gather more insights about the market drivers, restrains and growth of the Fire Truck Market

The outbreak of COVID-19 negatively impacted the market globally. Because of the stoppage of transit and international trade, makers of firefighting vehicles had to deal with some supply chain challenges. However, the industry started to pick up steam in the subsequent months, and throughout the projected period, it is anticipated that the demand for firefighting vehicles will increase significantly. The development of electric trucks and the rising popularity of firefighting equipment and local assemblies are projected to have a beneficial impact on the market for fire trucks.

The noticeable increase in demand for fire trucks can be attributed to factors such as new infrastructure development and an increase in fire incidents in residential and commercial spaces, as well as sanctuaries and wildlife areas. For instance, in 2021, the U.S. witnessed around 8,619 wildfires that destroyed 2.6 million acres of land as well as close to 3,629 structures, while it also involved extensive loss of human life.

One of the biggest markets for fire trucks is China due to the growing economy and rapid urbanization, combined with strict codes and standards for the decrease in infrastructural damage and loss that have created a need for fire trucks and emergency equipment. As China continues to build its civil aviation airport infrastructure, the need for fire and safety equipment keeps rising. The country built 43 airports between 2016 and 2020 and close to 6 new airports in 2021, bringing the number of airports operating in the country to 247.

Furthermore, the departments need to keep upgrading their equipment and apparatus owing to the constant technological advancements in the sector. As a result, frequent amendments are made to the guidelines and regulations enforced by associations such as the National Fire Protection Association (NFPA) in the U.S. and the National Association of Fire Equipment in India.

Infrastructural development in emerging countries has led regulatory bodies to enforce stringent codes and standards to decrease infrastructural damage and losses, which is expected to augment the industry’s growth. However, high preliminary costs and capital requirements for the manufacturing of trucks are expected to restrain the market growth to a certain extent over the forecast period.

Browse through Grand View Research's HVAC & Construction Industry Research Reports.

- The global autonomous construction equipment market size was estimated at USD 12.72 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030.

- The global demand response management system market size was valued at USD 8.74 billion in 2023 and is projected to grow at a CAGR of 16.3% from 2024 to 2030.

Fire Truck Market Segmentation

Grand View Research has segmented the global fire truck market based on application, type, and region:

Fire Truck Application Outlook (Revenue, USD Million, 2018 - 2030)

- Residential & Commercial

- Enterprise & Airports

- Military

- Others

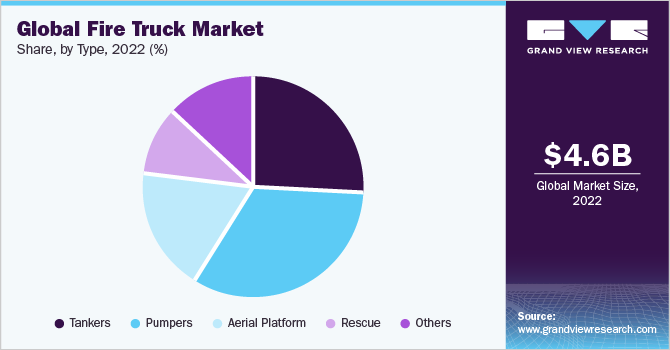

Fire Truck Type Outlook (Revenue, USD Million, 2018 - 2030)

- Tankers

- Pumpers

- Aerial Platform

- Rescue

- Others

Fire Truck Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Key Companies profiled:

- Rosenbauer International AG

- Oshkosh Corporation

- Magirus GmbH

- Weihai Guangtai

- Danko Emergency Equipment Co.

- E-One Inc.

- Spartan Motors

- Xuzhou Handler Special Vehicle Co. Ltd.

- Zoomlion

- Bronto Skylift Oy Ab

Recent Development

- In April 2023, E-ONE introduced the new Defender Type III Urba n-Interface Pumper, built to stand strong for the most challenging situations. The design features low battery cell placement for better stability while operating.

- In June 2022, Scania introduced a new hybrid solution for airport fire trucks. The new system allows more sustainable operations in and around airports and meets the strict aviation industry requirements.

- In June 2022, Oshkosh Corporation acquired Maxi-Métal Inc. to expand sales and distribution capabilities of fire apparatus and utility vehicles within Canadian market.

- In June 2021, Oshkosh Corporation introduced two new electric trucks to serve the airport fire & emergency market with new Volterra technology.

Order a free sample PDF of the Fire Truck Market Intelligence Study, published by Grand View Research.