Polyethylene Industry Overview

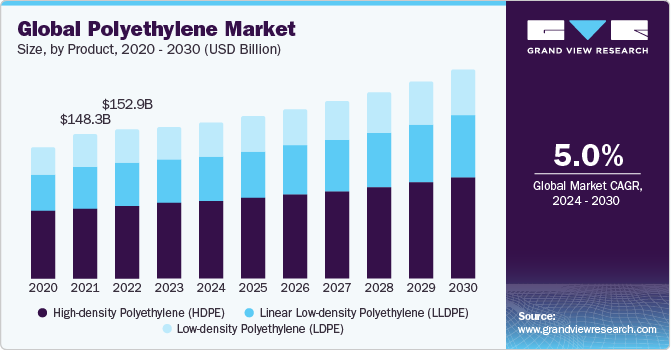

The global polyethylene market size was estimated at USD 155.18 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030.

The ongoing technological advancements in several end-use industries and the growing demand for lightweight and cost-effective products are expected to boost market growth over the forecast period. The growth of various end-use industries, such as packaging, construction, and automotive, fuels the demand for virgin polyethylene (PE). As these industries expand globally, the need for high-quality and consistent PE for manufacturing essential products like packaging materials, pipes, and automotive components rises, contributing to market growth.

Gather more insights about the market drivers, restrains and growth of the Polyethylene Market

In addition, population growth and rapid urbanization contribute significantly to the demand for virgin PE. The rising global population, particularly in developing regions, leads to increased consumption of products that utilize PE. Moreover, urbanization drives the need for infrastructure development, including construction projects that rely on PE for various applications. This demographic and societal shift results in a higher demand for virgin PE as a fundamental material in the construction and development processes.

One of the major challenges faced by the market includes fluctuations in raw material prices. The global crude oil prices have witnessed severe fluctuations in the past few years. Social disruption in key crude oil-producing regions, such as Venezuela, Libya, Iran, Nigeria, and Iraq has hampered crude oil supply, generating inelasticity in the supply-demand balance. These factors are short-lived in the market causing immediate fall and rise in prices, thus impacting market growth.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

- The global mechanical recycling of plastics market size was estimated at USD 35,170.05 million in 2023 and is projected to grow at a CAGR of 9.36% from 2024 to 2030.

- The global flexible paper packaging market size was estimated at USD 50.35 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030.

Polyethylene Market Segmentation

Grand View Research has segmented the global polyethylene market on the basis of product, application, end-use, and region:

PE Product Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

PE Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Bottles & Containers

- Films & Sheets

- Bags & Sacks

- Pipes & Fittings

- Other Applications

PE End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Packaging

- Construction

- Automotive

- Agriculture

- Consumer Electronics

- Other End-uses

PE Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Key Companies profiled:

- BASF SE

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Formosa Plastics

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- MOL Group

- SABIC

- China Petrochemical Corporation (Sinopec)

Key Polyethylene Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- In November 2023, Dow announced an investment in the Fort Saskatchewan Path2Zero project in Alberta, Canada, with an investment of USD 6.5 billion, as part of the company's goal to achieve carbon neutrality by 2050. The project involves the construction of a new ethylene plant and expanding polyethylene capacity by 2 million metric tons annually. The construction is scheduled to commence in 2024, and the increased capacity is set to be implemented in stages, with the initial phase anticipated to begin in 2027

- In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar PE unit within their Baystar joint venture. This PE unit, boasting a capacity of 625,000 metric tons annually, marks a significant increase, doubling the current production capabilities at the Baystar site including two existing PE production units

- In August 2023, Dow partnered with Mengniu, a dairy company, to launch a PE yogurt pouch, specifically designed for recyclability. This joint effort signifies a significant step for both companies in reinforcing their dedication to promoting a circular economy in China. The partnership with Mengniu enables both brands to take the lead in pioneering recyclable all-PE dairy packaging in the Chinese market.

Order a free sample PDF of the Polyethylene Market Intelligence Study, published by Grand View Research.